Lemons are great in lemonade, but they might not be your first choice in a gin and tonic. If professional employer organizations (PEOs) and employers of record (EORs) were both garnishes, like lemons and limes, they’d belong in different drinks.

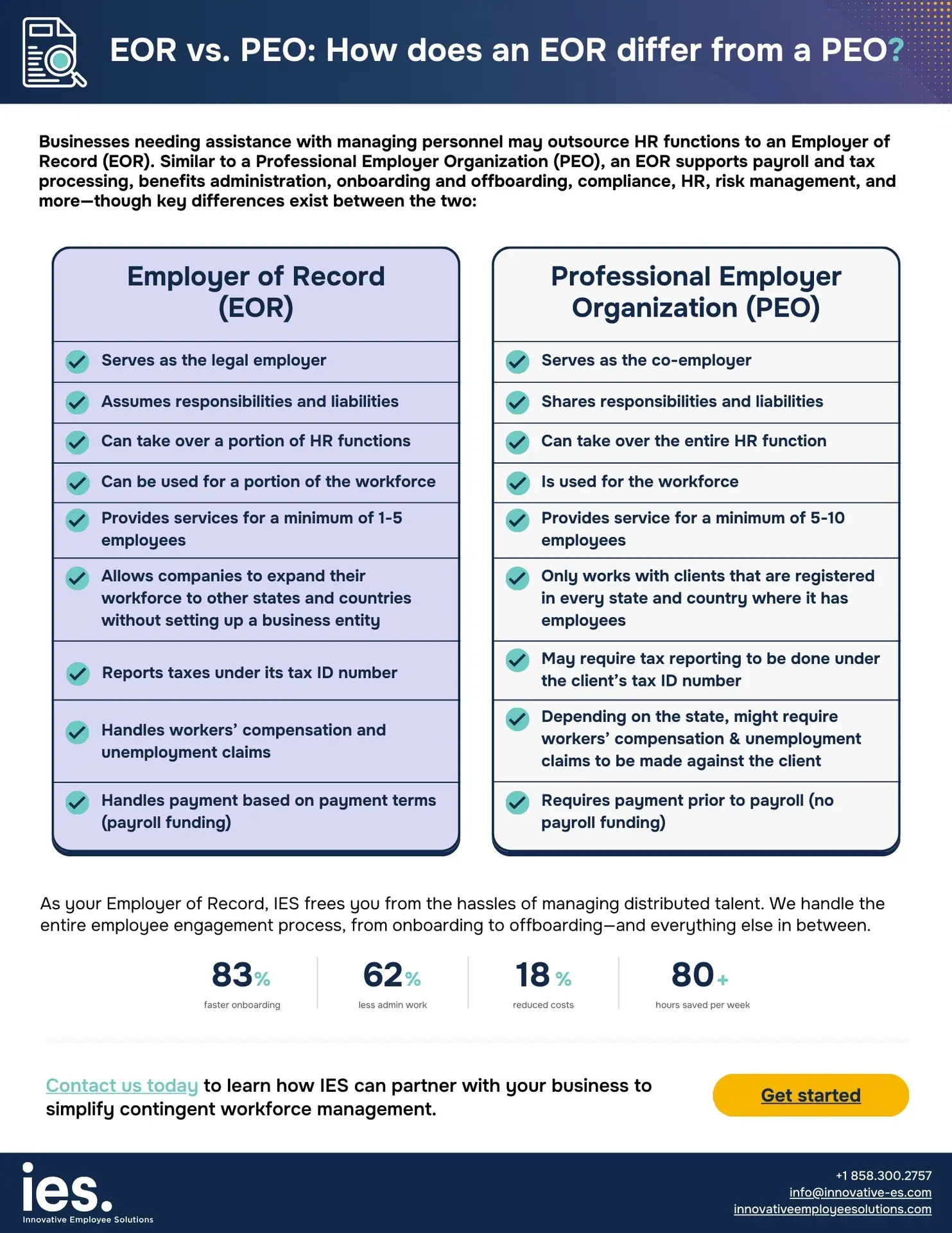

Although they seem similar, PEOs and EORs provide different services. An EOR puts a portion of your business and employees on its payroll. A PEO takes on all of your employees and provides all HR-related functions. Furthermore, you hold the employment contracts when working with a PEO, whereas an EOR keeps the employment contract, engaging you with a service agreement.

Why does this matter? Confusing the two can put you at legal risk. A PEO must be registered as such, so an EOR legally cannot function like a PEO. And, of course, you’ll get better results with the right recipe. Like that gin and tonic, your company requires just the right complement for a satisfying HR experience.

Where PEOs and EORs Differ

Both PEOs and EORs act as an extension of your company. Their small but significant differences lie in four key areas:

1. Replacement or complement

While you might make a mean drink yourself, sometimes it’s better to let a bartender mix the cocktails. Similarly, a PEO can tackle most of your HR functions and take all of your company’s employees onto the PEO’s payroll. The PEO handles all of the onboarding, terminations, employee reviews, State Unemployment Tax Act (SUTA) and Federal Unemployment Tax Act (FUTA) rates, health insurance, and more.

Maybe you don’t want to make the drinks but you’re comfortable pouring the wine and beer. Well, an EOR lets you outsource part of your HR work, taking the administration for a subset of your workforce off of your HR department’s plate. An EOR oversees seasonal workers, contractors, project-specific hires, and out-of-state employees.

2. Employee minimums

Most PEOs want to make sure enough people are coming to the party, requiring a minimum of five to 10 employees; most EORs do not. Because EORs are usually used for fluctuating or contractor-based workforces, they’re typically more willing to work with small businesses that might have just one or two regular employees.

Especially on such small teams, employing contractors for short periods of time can create HR headaches. Without an EOR, one of those regular employees needs to be an expert in the Fair Labor Standards Act and related employment laws. EORs know these laws inside and out, and they’ll take responsibility for all of the taxes, insurance, and benefits associated with contingent workers.

3. Business registration

One thing that a PEO won’t take off your plate? Business registration — in every state where your employees are located. An EOR, on the other hand, allows you employ workers in other states even if your company isn’t registered there. Registering your company in another state can be a simple process or a complicated endeavor. If you’re a sole proprietorship or partnership, you just need to file doing business as documents. C corporations, S corporations, and limited liability companies have much more to consider.

If you fall into the latter group, consider whether an EOR can meet your needs instead. If you have to go to great lengths to source mint, you’ll probably pull mojitos off the menu.

4. Insurance coverages

Insurance is perhaps the biggest hidden cost of working with PEOs. While EORs provide general liability (GL) and workers’ compensation (WC) insurance coverage, PEOs may require you to provide your own insurance. EORs make sure the employees they oversee are covered for damages, such as those caused to property or other people, as well as workplace-related illnesses or injuries.

PEOs often have difficulty securing WC in non-clerical industries. If your company falls into this category, you’ll probably need to insure yourself. The party can go off as long as the business owner holds the liquor license, so this may not make or break your decision, but it’s important to know upfront.

Selecting the Right Service

Much of the PEO-EOR choice comes down to your workforce strategy. Are you bringing on a crop of contingent workers for the short term? Then, an EOR is the way to go. Are you looking to outsource every HR function you can, from onboarding to benefits administration? Hire a PEO.

But maybe you like gin and tonics with either lime or lemon. If your situation isn’t so clear-cut, contact us for a consultation. We’ll take a look at the types of talent you engage, listen to your business goals, and serve up a suggestion tailored to you. No matter the time of day, our bar is open for business!

Let’s break it down in a quick reference cheat sheet!

IES is here to help! If you could use some outside expertise in handling your contingent employees, contact us today to get a conversations started! Email us at info@innovative-es.com or call 858-300-2757.

Written By: Kara Hertzog, President

Kara Hertzog is the President at Innovative Employee Solutions (IES), a leading global employer of record that specializes in payrolling and contractor management services for today’s contingent workforce. Founded in 1974 in San Diego, IES has grown into one of the city’s largest women-owned businesses and has been named one of its “Best Places to Work” for 10 years in a row.